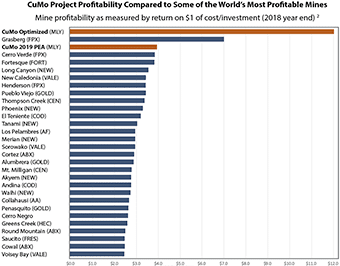

MultiMet has identified significant quantities of molybdenum, copper silver,rhenium and potentially tungsten at the CuMo Project. The Company anticipates that project cash and total costs could be significantly reduced from steady by-product credits from these well-priced and in-demand metals, potentially making the CuMo Project profitable in most metal-market price conditions. Production costs are currently estimated to be $3.81/lb molybdenum metal or $1.36/lb copper equivalent. ¹ Recent studies of the use of modern mining technologies indicate the possibility that these costs can be reduced to those similar to by-product producers (less than $1.00/lb molybdenum metal).

As a potential low-cost, primary molybdenum producer, the CuMo Project is expected to have significant advantages over high-cost underground or remote producers.

NOTE: Pre-feasibility target range is 0.25 to $1.25 per pound Molybdenum (Mo) net by-products. This can be achieved by optimizing the use of conveyors, using finer sized ore sorting, improving grinding in mill circuit and increasing cutoff.

i. At current price of $12.65 with 2018 low of $6.92/lb of Molybdenum

ii.Chart represents approximately 93% of total Molybdenum production.

Source: Minecost.com, CPM Group, SNL and company documents.

Click each table on the right to view larger.

Strong economic potential.

Strong economic potential.The CuMo Project’s potential profitability is far greater by duplicating the practices of the large copper and gold porphyry deposit miners, a new approach in molybdenum mining. In contrast to small-sized, high-grade projects, the CuMo Project can provide huge economies of scale, higher production rates and return significant profits. Examples of this low-cost, high-profitability model include: Highland Valley, Morenci, and Sierrita. Highland Valley was placed into initial production to mine material worth $8 per ton for a cost of $4. Using large-scale mining infrastructure, the CuMo Project is targeting mining material with a recovered value per ton in excess of $25 for $10 or less per ton (2019 PEA mining costs). ¹

CuMo based on 150K tons per day and >$7.50 recovered value. Metal prices used are $15 per lb. Molybdenum (Mo),$3 per lb. Copper, $17.5 per ounce Silver,$1450 per ounce Gold, $25 per lb. Uranium, $6 per lb. Nickel, $1.10 per lb. Zinc, 0.95 per lb. Lead and $14 per lb. Cobalt.

Click each table on the right to view larger.

_______________________________________________________________________________

1 SRK Consulting Preliminary Economic Analysis & 43-101 Technical Report for the CuMo Project August 2019.

2 CCompany Financial Statements and Costing Reports, CPM group and mining cost data. CuMo Project (Typical Year) and CuMo Project (150K per day) are based upon the SRK PEA net of credits for copper and silver.¹

DISCLAIMERS: Targets are conceptual in nature as there had been insufficient work done as defined by NI 43-101, and it is uncertain if further exploration and other work would result in establishing the existence of Mineral Resources. Then target is based on a increases in the sorting results based on preliminary test work at the fine level and a 1reduction in operating costs due to switching from truck to in-pit conveyors and mill improvements.

The preliminary economic assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

NOTE: Molybdenum Oxide Price is used which is less than current spot quoted prices which quote molybdenum as price per lb molybdenum metal contained as molybdenum oxide. So a price of $15 per lb molybdenum metal is equivalent to $10 per lb molybdenum oxide.